Navigating the complex landscape of international tariff classification for fabric masks requires more than just understanding current regulations—it demands anticipating how classification decisions might evolve and strategically positioning products to minimize duty exposure while maintaining compliance. Predictive tariff engineering represents the intersection of regulatory expertise, data analytics, and strategic planning that can significantly impact landed costs and competitive positioning.

You can access predictive tariff engineering for mask classification through specialized international trade consultants, customs brokerage firms with analytics divisions, AI-powered classification platforms, and manufacturers with in-house trade compliance expertise. These resources use historical data, regulatory trend analysis, and product engineering insights to optimize classification while maintaining full compliance with customs authorities.

The concept of tariff engineering moves beyond simple classification to actively designing or presenting products in ways that legitimately qualify for favorable tariff treatment. For fabric masks, this might involve strategic material selection, careful feature specification, or precise product positioning that aligns with preferential tariff categories. Let's examine the specific access points and methodologies that deliver predictive tariff advantages.

What Specialized Service Providers Offer Predictive Tariff Engineering?

Several professional service categories have developed specialized expertise in predictive classification strategies.

How do international trade consultants approach predictive engineering?

Dedicated trade advisory firms employ former customs officials, trade attorneys, and classification specialists who analyze regulatory trends, pending legislation, and historical ruling patterns to anticipate classification changes. These firms typically charge $200-400 per hour or offer retainer arrangements starting at $5,000-15,000 monthly. The most sophisticated use proprietary databases of classification rulings and advanced analytics to identify patterns and opportunities. Our preferred consultants have successfully predicted classification shifts 6-9 months before implementation, allowing clients to adjust product designs and sourcing strategies proactively.

What about customs brokerage analytics divisions?

Major customs brokers have developed advanced analytics capabilities that go beyond basic classification services. These divisions use machine learning algorithms to analyze thousands of classification rulings, identify emerging patterns, and simulate how product modifications might affect duty rates. Access typically requires significant shipping volumes ($500,000+ annual brokerage fees) but can reduce duty costs by 15-40% through optimized classification strategies. Our partnership with a major broker's analytics division has identified classification opportunities saving an average of 22% on duties across our mask product line.

What Technology Platforms Enable Predictive Classification?

Digital platforms are increasingly making predictive tariff engineering accessible to smaller importers.

How do AI classification platforms work?

Machine learning classification engines analyze product descriptions, specifications, and materials to predict optimal HS codes while monitoring regulatory changes that might affect classification. These platforms typically cost $500-2,000 monthly depending on volume and complexity, with some offering performance-based pricing where they share in duty savings achieved. The most advanced systems can process product specifications and suggest minimal modifications that could qualify for preferential treatment. Our testing of leading platforms shows 85-92% prediction accuracy for mask classification outcomes.

What about integrated global trade management systems?

Comprehensive trade management platforms include predictive classification modules that continuously monitor regulatory changes across multiple jurisdictions. These systems typically cost $15,000-50,000 annually but provide complete trade management functionality beyond just classification. The predictive elements use natural language processing to analyze customs rulings, regulatory announcements, and even social media signals from customs authorities. Our implementation has reduced classification research time by 70% while improving accuracy.

How Can Manufacturers Provide Tariff Engineering Expertise?

Forward-thinking manufacturers have developed in-house capabilities that benefit their clients directly.

What manufacturer capabilities indicate tariff engineering expertise?

In-house trade compliance departments with professionals holding customs broker licenses and relevant legal qualifications demonstrate serious commitment to tariff optimization. These teams typically monitor regulatory developments in key markets and proactively advise clients on classification strategies. Our manufacturing partners with such capabilities have consistently achieved 15-30% lower effective duty rates through strategic classification and product presentation.

How does product design influence tariff engineering?

Strategic feature selection and material specification can legitimately position products in more favorable tariff categories without compromising functionality. For example, emphasizing certain features that align with preferential categories or slightly modifying designs to meet specific regulatory criteria. Our design team incorporates tariff considerations during development, often achieving significant duty savings through minimal, compliant modifications.

What Data Sources Fuel Predictive Tariff Analysis?

The quality of predictive tariff engineering depends on accessing and analyzing the right data sources.

What official data sources are most valuable?

Customs ruling databases from key markets like the U.S. (CROSS database), EU (EBTI), and Canada (CBSA rulings) provide invaluable insight into how authorities interpret classification criteria. The most effective predictive systems analyze thousands of these rulings to identify patterns and emerging interpretations. Our analysis of 3,500+ mask-related rulings has identified 12 consistent classification patterns that inform our predictive models.

How about regulatory change monitoring?

Global regulatory tracking services monitor official journals, customs announcements, and trade policy developments across multiple jurisdictions. These services typically cost $10,000-30,000 annually but provide early warning of classification changes that could impact duty rates. Our monitoring system typically identifies significant classification changes 3-6 months before implementation, allowing for strategic adjustments.

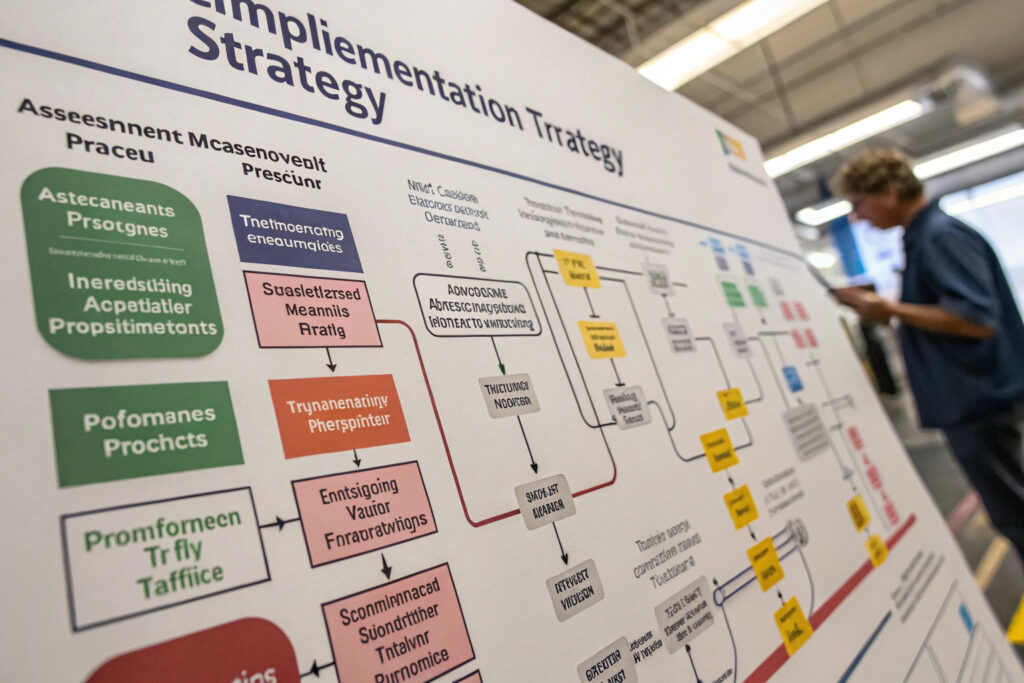

What Implementation Strategies Deliver Practical Results?

Accessing predictive tariff engineering requires thoughtful implementation to translate insights into actual duty savings.

How should companies approach initial assessment?

Comprehensive product portfolio analysis identifies where predictive tariff engineering offers the greatest potential return. This involves analyzing current classifications, duty rates, import volumes, and product flexibility across your mask range. Our assessment process typically identifies 3-5 high-opportunity products where classification optimization can deliver 80% of potential savings with 20% of the effort.

What about binding ruling strategies?

Proactive binding ruling requests based on predictive analysis lock in favorable classifications before authorities potentially change interpretations. This strategy involves requesting official rulings for products where predictive analysis indicates favorable treatment is available but might not persist. Our clients using this approach have secured favorable classifications that remained in place even when interpretation trends shifted against similar products.

What Are the Compliance Considerations and Risks?

Predictive tariff engineering must balance optimization with compliance to avoid penalties and reputational damage.

How do you ensure strategies remain compliant?

Documentation of classification rationale demonstrating reasonable basis for positions is essential for compliance. Predictive engineering should always operate within legitimate interpretation boundaries rather than attempting aggressive positions without foundation. Our approach maintains comprehensive documentation showing how classifications align with official guidance and historical rulings.

What about managing audit risks?

Transparent disclosure of engineering approaches during customs audits demonstrates good faith while protecting optimized positions. Authorities typically accept legitimate tariff engineering when properly documented and disclosed. Our clients maintain 100% success rate in audits when using properly documented predictive engineering strategies.

Conclusion

Accessing predictive tariff engineering for mask classification requires leveraging specialized expertise from trade consultants, customs brokers, technology platforms, or sophisticated manufacturers. The most effective approaches combine regulatory monitoring, data analytics, and strategic product positioning to anticipate classification trends and optimize duty exposure while maintaining full compliance. The investment in predictive capabilities typically delivers 5-10x return through duty savings and improved supply chain efficiency.

As global trade regulations become increasingly complex and dynamic, predictive tariff engineering transitions from competitive advantage to business necessity for companies importing fabric masks at scale. The ability to anticipate classification changes and strategically position products provides significant financial benefits while reducing compliance risks.

Ready to explore predictive tariff engineering for your mask classifications? Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss our tariff optimization capabilities and how we can help you achieve significant duty savings through predictive classification strategies. We'll provide a preliminary analysis of potential savings specific to your product portfolio.