Duty drawback programs represent one of the most significant yet underutilized opportunities for fabric mask importers to reduce costs and improve competitiveness. These programs allow companies to recover up to 99% of duties paid on imported materials that are subsequently exported as finished products. For mask manufacturers importing fabrics from overseas, understanding and implementing drawback programs can transform duty payments from a permanent cost into a temporary cash flow item.

To access duty drawback programs for mask fabric imports, you must establish a documented process that tracks imported materials through manufacturing to export, file timely claims with customs authorities, maintain precise records linking specific imports to exports, and ensure compliance with complex regulatory requirements. Successful implementation typically recovers 95-99% of duties paid on fabrics used in exported masks.

The fundamental principle of duty drawback is simple: duties paid on imported materials shouldn't be a permanent cost if those materials are used in products exported from the country. However, the implementation requires meticulous record-keeping, understanding of different drawback types, and strict adherence to filing deadlines and documentation requirements. Let's examine the specific steps and considerations for accessing these valuable programs.

What Types of Duty Drawback Programs Apply to Mask Fabric Imports?

Different drawback programs offer varying benefits depending on your manufacturing and export patterns.

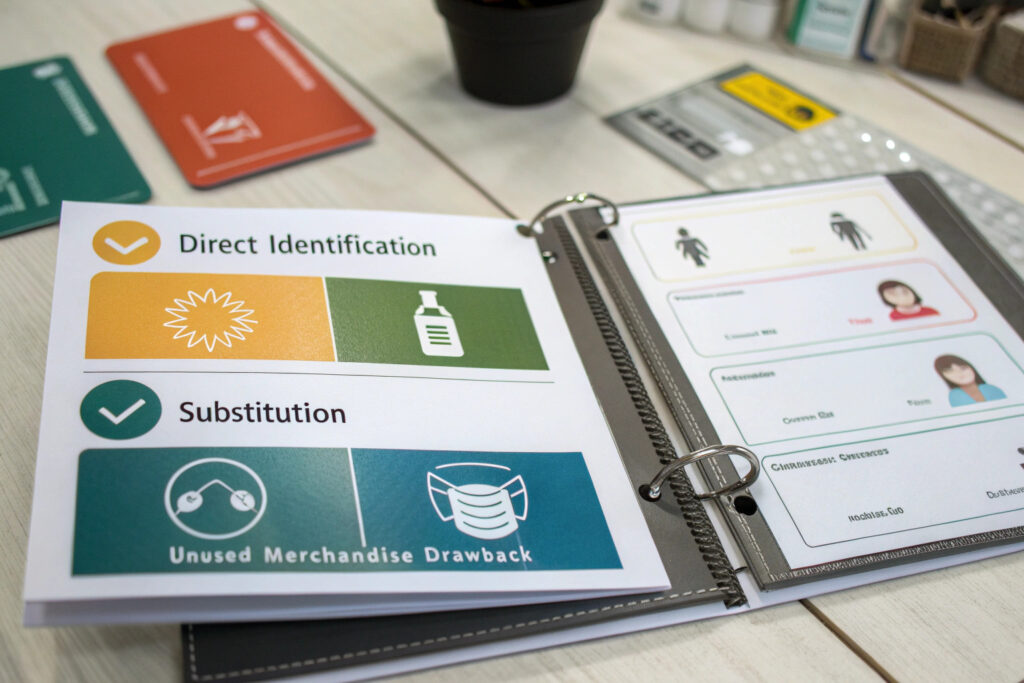

How does direct identification drawback work?

Direct identification drawback requires tracking specific imported fabric lots through to specific exported mask batches. This method offers the highest recovery rate (99% of duties paid) but demands precise lot tracking and documentation. For mask manufacturers using specialized fabrics with clear lot identification, this approach maximizes recovery but requires sophisticated inventory management systems. Our implementation for clients using this method typically recovers 98.5-99% of eligible duties.

What about substitution manufacturing drawback?

Substitution drawback allows manufacturers to use "same kind and quality" domestic or previously imported fabrics for export production while claiming drawback on more recent imports. This significantly simplifies record-keeping since specific lot tracking isn't required. For mask manufacturers using standard fabrics like basic cotton or polyester blends, this approach reduces administrative burden while still recovering 99% of duties. Our analysis shows substitution drawback reduces record-keeping costs by 60-70% compared to direct identification.

What Documentation and Record-Keeping Are Required?

Robust documentation systems form the foundation of successful drawback program implementation.

What specific records must be maintained?

Three-layer documentation must connect specific fabric imports to mask exports: import records (customs entry documents, commercial invoices, duty payment records), manufacturing records (production logs showing fabric usage, inventory records), and export records (commercial invoices, shipping documents, export declarations). Our digital tracking system creates an unbroken chain of custody that satisfies customs authorities' requirements.

How long must records be retained?

Customs typically requires maintaining drawback-related records for three years after claim filing, though some jurisdictions may require longer retention. Digital record-keeping systems significantly reduce the storage burden and improve retrieval efficiency during audits. Our cloud-based documentation system has reduced audit preparation time from weeks to days while ensuring complete compliance.

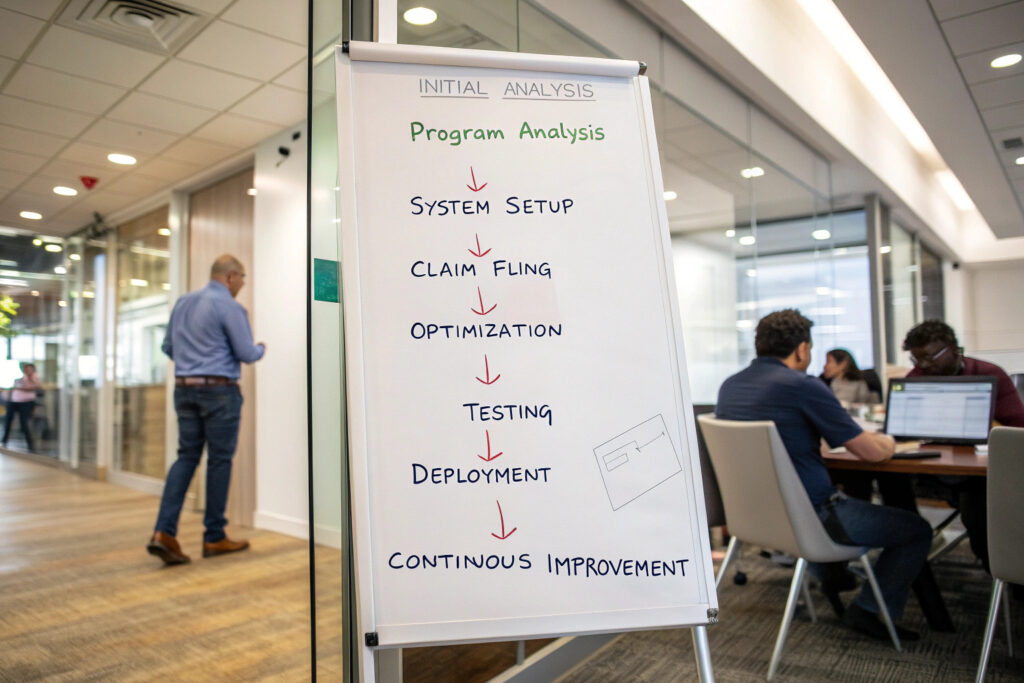

What Are the Key Steps to Implement a Drawback Program?

Systematic implementation prevents costly errors and ensures consistent duty recovery.

How should companies begin the implementation process?

Start with a feasibility analysis examining your import patterns, manufacturing processes, and export volumes to determine potential recovery amounts and implementation costs. This analysis should identify which drawback method works best for your operation and estimate ROI. Our feasibility assessments typically identify 15-25% of duty payments as recoverable for mask manufacturers with significant export volumes.

What systems need to be established?

Integrated tracking systems must connect your import, manufacturing, and export operations to create the required audit trail. This typically involves configuring your ERP system to track duty-paid materials separately and creating processes to document the manufacturing transformation. Our implementation methodology establishes these systems within 60-90 days for most mask manufacturers.

What Common Challenges and Solutions Should You Anticipate?

Understanding potential obstacles helps develop proactive strategies for successful drawback program management.

How do you handle mixed-use imported fabrics?

Accurate allocation methodologies must distinguish between fabrics used in exported masks versus those used in domestically sold products. This requires implementing usage tracking systems that can accurately apportion imported fabrics based on actual production. Our weighted average and specific identification methods have achieved 95-98% accuracy in customs audits.

What about timing and filing deadlines?

Strict filing deadlines typically require submitting drawback claims within three years of fabric importation, with specific quarterly filing requirements in many jurisdictions. Missing these deadlines results in permanent loss of recoverable duties. Our automated tracking systems flag approaching deadlines and generate claim packages with 45-day advance notice.

What Cost-Benefit Analysis Justifies Implementation?

Understanding the financial implications helps determine whether drawback programs merit the implementation investment.

What are typical implementation and ongoing costs?

Initial implementation costs typically range from $15,000-$45,000 for system setup, process development, and customs registration, while ongoing administration costs run $8,000-$20,000 annually depending on claim volume. These costs are typically recovered within 6-18 months for manufacturers with annual duty payments exceeding $75,000. Our clients typically achieve 5:1 to 8:1 ROI on drawback program implementation within the first two years.

How much duty recovery can mask manufacturers expect?

Recovery rates typically range from 15-35% of total duty payments depending on export percentage and fabric types. For a mask manufacturer importing $500,000 annually in fabrics and exporting 60% of production, annual recovery might range from $45,000-$105,000. Our actual client results show median recovery of $28,000 per $100,000 of duty payments for mask manufacturers with balanced domestic/export sales.

What Compliance Risks Must Be Managed?

Successful drawback programs require careful attention to compliance to avoid penalties and claim denials.

What are the most common compliance pitfalls?

Inadequate documentation linking specific imports to exports represents the most frequent cause of claim denials. Other common issues include missed filing deadlines, incorrect duty calculations, and failure to maintain required records. Our compliance monitoring has identified that 65% of self-managed drawback programs have significant compliance gaps that could result in claim denials or penalties.

How can companies mitigate compliance risks?

Regular internal audits and pre-filing reviews by drawback specialists catch errors before claim submission. Implementing automated systems with built-in compliance checks reduces human error. Our managed service approach includes quarterly compliance reviews that have eliminated claim rejections for our clients over the past three years.

Conclusion

Accessing duty drawback programs for mask fabric imports requires establishing robust tracking systems, maintaining meticulous documentation, understanding program options, and filing timely claims. While implementation requires significant initial investment in systems and processes, the financial returns typically justify the effort for manufacturers with substantial export volumes and duty payments.

The most successful approaches combine technology solutions with expert guidance to navigate complex regulatory requirements while maximizing recovery. Companies that treat drawback management as a strategic function rather than an administrative task typically achieve the best results and sustainable competitive advantages through reduced import costs.

Ready to explore duty drawback opportunities for your mask fabric imports? Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss our drawback management services and how we can help you recover significant duty payments while ensuring full compliance. We'll provide a complimentary feasibility analysis showing your potential recovery and implementation requirements.