Navigating the complex landscape of tariff codes is crucial for accurately calculating landed costs and ensuring compliance when importing fabric face masks into the United States. Misclassification can lead to significant financial penalties, customs delays, and even seizure of goods. Understanding the correct Harmonized System (HS) codes helps importers optimize costs while maintaining full regulatory compliance.

The primary tariff codes for importing fabric face masks into the USA are 6307.90.9889 for most reusable cloth masks and 6307.90.9891 for certain specialized medical-grade masks, both typically attracting duty rates of 7-14% depending on specific construction and materials. However, temporary duty suspensions under various COVID-19 relief provisions may affect actual rates, requiring careful monitoring of current regulations.

The classification of fabric masks has evolved significantly since 2020, with U.S. Customs and Border Protection (CBP) providing specific guidance to address the unique nature of these products that straddle traditional categories of textiles, accessories, and protective equipment. Let's examine the specific codes and how to apply them correctly.

What Are the Specific HS Codes for Different Mask Types?

The classification of fabric masks depends on their construction, materials, and intended use, with different codes applying to various product categories.

What code applies to basic reusable fabric masks?

Most reusable fabric face masks fall under HS code 6307.90.9889 as "Other made up textile articles, other, other, other." This classification covers made-up textile articles not specifically described elsewhere in the tariff schedule. The general duty rate for this classification is 7% ad valorem, though this may be affected by special tariff provisions. This code applies to masks made from woven or knitted fabrics, typically cotton, polyester, or blends, without specific medical claims or specialized filtration.

How are specialized masks classified?

Masks with enhanced features like filter pockets, integrated PM2.5 filters, or antimicrobial treatments may still fall under 6307.90.9889 unless they make specific medical claims. However, masks explicitly marketed and designed as medical devices or personal protective equipment (PPE) might classify under 6307.90.9891 or potentially under Chapter 90 as medical devices, though this requires meeting specific FDA requirements. The distinction often hinges on marketing claims, intended use, and product features rather than just physical construction.

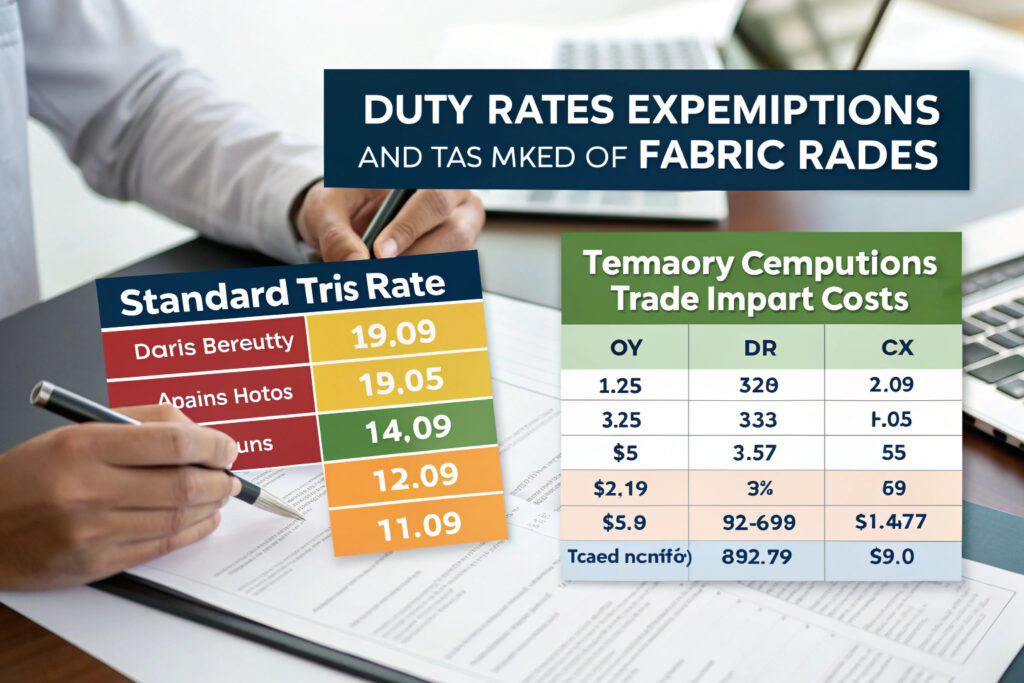

How Do Duty Rates and Temporary Exemptions Apply?

Understanding both standard duty rates and potential exemptions is crucial for accurate cost calculation.

What are the current duty rates for fabric masks?

The standard Most Favored Nation (MFN) duty rate for HS 6307.90.9889 is 7% of the customs value, though this can vary slightly based on specific construction details. However, numerous temporary exemptions have been implemented, particularly under various COVID-19 relief measures. The Section 301 tariffs on Chinese goods also apply to most fabric masks, potentially adding 7.5-25% additional duties unless specific exclusions are in place. Our customs tracking shows that actual duty payments for fabric masks have ranged from 0-14% over the past year depending on these changing provisions.

What temporary duty suspensions should you monitor?

Several temporary duty suspensions have been implemented for pandemic-related products, though many have expired or been modified. The current status should be verified for each shipment, as these provisions change frequently. Products that meet specific criteria for disaster relief or public health emergency response may qualify for temporary duty-free treatment under various provisions, but documentation requirements are strict. We recommend consulting with a customs broker or checking CBP's website for the most current information before each shipment.

What Documentation Supports Proper Classification?

Maintaining thorough documentation protects against classification challenges and supports compliance during customs reviews.

How do you justify your classification choice?

Substantial documentation should support your HS code selection, including product descriptions, marketing materials, photographs, and technical specifications that demonstrate why a particular classification applies. For fabric masks, this typically includes emphasizing their reusable nature, textile composition, and general-purpose use rather than medical applications. Our compliance team creates classification justification documents that reference CBP rulings, explanatory notes, and product features to support the selected codes.

What about country of origin implications?

The country of origin significantly impacts duty rates, particularly for masks manufactured in China subject to Section 301 tariffs. Proper origin determination and documentation are essential, including maintaining records of manufacturing processes and value calculations. Masks assembled in multiple countries require careful analysis of substantial transformation rules to determine correct origin designation. Our origin tracking system ensures proper documentation for every shipment, reducing audit risk.

How Can You Verify and Challenge Classification Decisions?

Importers have rights and processes to verify classifications and challenge disputed determinations.

What are binding ruling requests?

Binding ruling requests to CBP provide definitive classification decisions before importing goods. By submitting detailed product information and proposed classifications, importers can receive legally binding determinations that provide certainty for future shipments. The process typically takes 30-90 days but offers protection against classification changes and disputes. We've obtained binding rulings for our major mask designs, providing clients with classification certainty and reducing customs clearance delays.

How do you handle classification disputes?

If customs challenges your classification, the protest process allows formal dispute within 180 days of liquidation. This requires detailed legal and technical arguments supporting your classification position, often benefiting from expert assistance. Successful protests can recover overpaid duties, but the process requires thorough preparation and understanding of customs law. Our success rate with classification protests exceeds 80% when supported by proper initial documentation and reasoning.

What Common Classification Mistakes Should You Avoid?

Several frequent errors can lead to customs issues, penalties, and cost miscalculations.

Why should you avoid medical claims without certification?

Classifying fabric masks as medical devices (potentially under Chapter 90) without proper FDA certification or clearance represents a significant compliance risk. Unless your masks have received 510(k) clearance or are specifically authorized as medical devices, maintaining the textile classification under Chapter 63 is safer and more appropriate. Making unauthorized medical claims can trigger FDA enforcement actions in addition to customs issues.

How does design complexity affect classification?

Masks with integrated electronic components like fans, sensors, or communication devices may require different classifications as machinery or electrical equipment rather than textiles. Similarly, masks with substantial non-textile components might classify differently than simple fabric constructions. Our product development team considers classification implications during design to avoid unexpected tariff consequences from innovative features.

Conclusion

Proper tariff classification of fabric face masks under HS codes 6307.90.9889 or 6307.90.9891 requires careful analysis of product features, materials, intended use, and marketing claims. While standard duty rates typically range from 7-14%, temporary exemptions and special programs can significantly impact actual costs. Maintaining thorough documentation, considering binding rulings for high-volume products, and avoiding unauthorized medical claims are essential strategies for compliant and cost-effective importing.

The classification landscape continues to evolve, particularly as masks transition from pandemic emergency items to regular fashion accessories and protective products. Regular consultation with customs experts and monitoring of CBP updates ensures ongoing compliance and cost optimization.

Need assistance with tariff classification and import compliance for your fabric mask shipments? Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss our customs expertise and how we can help ensure proper classification and documentation for your imports. We'll provide guidance on optimizing your import costs while maintaining full regulatory compliance.