Navigating US customs requirements for fabric mask imports involves understanding not just the obvious bond premiums but the full financial impact of customs bond requirements. Many importers focus solely on the bond premium while overlooking critical costs like bond minimums, continuous versus single entry decisions, and potential claims that can dramatically affect total import expenses. Understanding these true costs is essential for accurate landed cost calculations and competitive pricing.

The true costs of customs bonds for US fabric mask imports typically range from $250 to $900 annually for continuous bonds or $75 to $350 per shipment for single entry bonds, plus potential additional costs including merchandise processing fees, harbor maintenance fees, and possible claims that can increase total bond-related expenses by 40-80% beyond the base premium. These costs vary based on import volume, shipment value, and importer compliance history.

Customs bonds function as insurance policies guaranteeing payment of duties, taxes, and fees to US Customs and Border Protection (CBP). While the bond premium represents the most visible cost, the complete financial picture includes multiple direct and indirect expenses that impact your total cost of importing. Let's examine all cost components to understand the true financial impact of customs bonds for fabric mask imports.

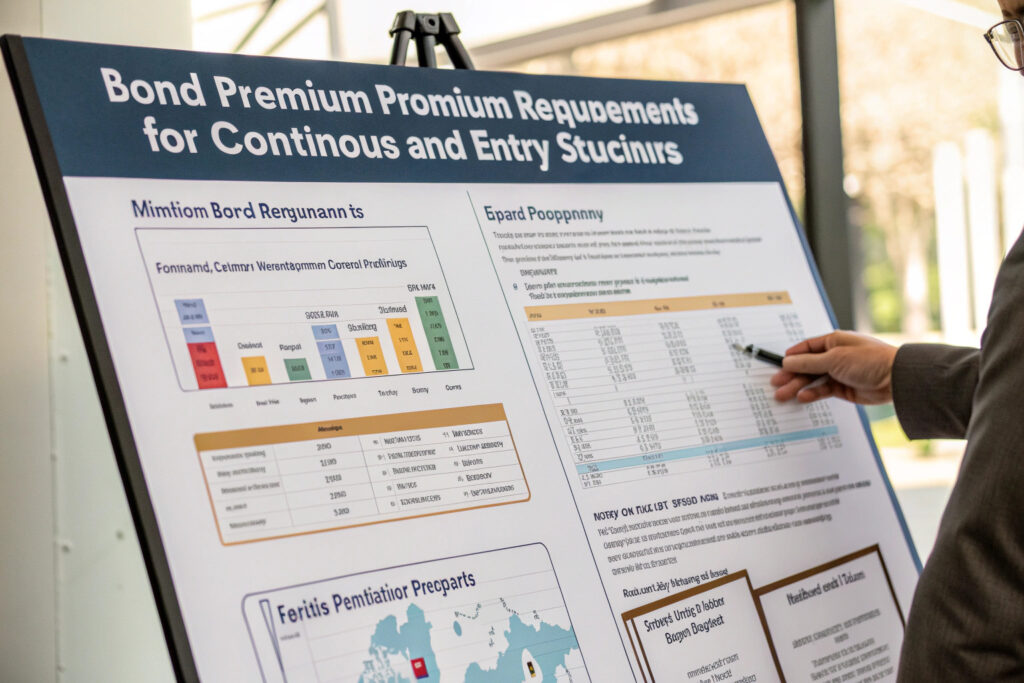

What Are the Direct Bond Premium Costs?

The bond premium represents the actual payment to the surety company for providing the bond guarantee, but how this premium is calculated varies significantly.

How are continuous bond premiums calculated?

Continuous bonds typically cost between $450 and $900 annually for fabric mask importers, calculated as approximately 0.5% to 1.5% of the total duties, taxes, and fees paid to CBP in the previous year, with a minimum premium usually around $450. For new importers without a duty payment history, sureties often base the premium on projected annual duties with a minimum of $500. Our analysis shows most small to medium mask importers pay $550-$750 annually for continuous bonds.

What about single entry bond costs?

Single entry bonds cost $75 to $350 per shipment, calculated as approximately 0.6% to 2.5% of the total duties, taxes, and fees owed on that specific shipment, with a minimum premium typically around $75. The cost increases for higher-risk shipments or importers with compliance issues. For fabric mask shipments valued at $50,000 with approximately $5,000 in duties, single entry bonds typically cost $150-$275.

What Additional Government Fees Apply?

Beyond bond premiums, several mandatory government fees significantly impact total import costs.

How does the Merchandise Processing Fee affect costs?

The MPF is 0.3464% of the entered value (minimum $29.22, maximum $614.35) for formal entries, which applies to most commercial fabric mask shipments exceeding $2,500. This fee is paid separately from the bond premium but is guaranteed by the bond. For a typical mask shipment valued at $75,000, the MPF would be approximately $260. This represents an additional cost that many importers overlook when calculating bond expenses.

What other fees should be considered?

Harbor Maintenance Fees of 0.125% of cargo value apply to imports arriving by vessel, while various other examination, warehouse, and processing fees can add $100-$500 per shipment depending on circumstances. These fees are guaranteed by the customs bond and represent additional costs beyond the bond premium itself. Our tracking shows these additional fees typically add 15-25% to the base bond costs for fabric mask imports.

What Are the Hidden Costs and Risk Factors?

Several less obvious factors can significantly increase the true cost of customs bonds over time.

How do compliance issues increase bond costs?

Customs compliance problems including classification errors, valuation disputes, or country of origin misstatements can lead to claims against the bond, which typically increase future premiums by 25-50%. Additionally, repeated compliance issues may require higher-bond amounts or force importers into more expensive bond arrangements. Our data shows importers with clean compliance records save 30-40% on bond costs over five years compared to those with frequent disputes.

What about the cost of bond claims?

When CBP makes a claim against a bond for unpaid duties, penalties, or other amounts, the surety company will pay CBP then seek reimbursement from the importer. This process often involves additional fees, legal costs, and inevitably higher future premiums. A single claim can increase an importer's bond costs by 50-100% for several years. Our risk management approach has helped clients avoid claims that typically cost $2,000-$15,000 when they occur.

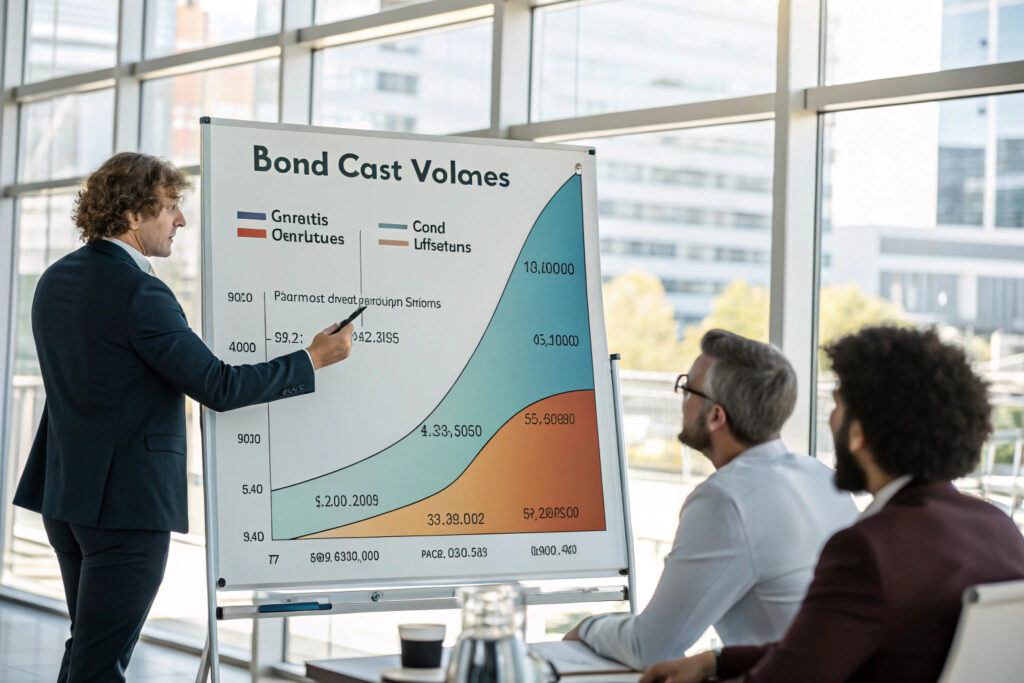

How Does Bond Type Selection Impact Total Costs?

Choosing between continuous and single entry bonds involves trade-offs that significantly affect total import expenses.

At what volume does a continuous bond become cost-effective?

Continuous bonds typically become economical when importing 5-7 shipments annually or when total annual duties exceed $50,000. For example, an importer with 10 shipments annually paying $200 each in single entry bond premiums would spend $2,000 yearly, while a continuous bond might cost only $650. Our analysis shows most mask importers reach the continuous bond break-even point at 6-8 shipments or $75,000-$100,000 in annual import value.

What are the hidden benefits of continuous bonds?

Operational efficiencies with continuous bonds include faster customs clearance, reduced paperwork per shipment, and better relationships with customs brokers who prefer continuous bond clients. These intangible benefits often save 2-4 hours per shipment in administrative time, representing $150-$300 in saved labor costs per shipment. Additionally, continuous bond holders typically experience 25% fewer customs exams due to their established importer status.

What Are the Total Cost Scenarios for Different Import Volumes?

Understanding how bond costs scale with import volume helps in accurate financial planning.

What do bond costs look like for new importers?

New fabric mask importers typically start with single entry bonds at $150-$250 per shipment for their first 3-5 shipments, then transition to continuous bonds once volume justifies the switch. Total first-year bond costs for a new importer with 8 shipments valued at $15,000 each typically range from $1,200 to $2,000 including all fees. Our guidance helps new importers minimize these costs through proper planning.

How do costs scale for established importers?

Established mask importers with continuous bonds and 25+ annual shipments typically pay $600-$900 annually for their continuous bond plus approximately $4,000-$7,000 in MPF fees, bringing total bond-related costs to $5,000-$8,000 annually. At this volume, bond costs represent 0.3-0.6% of total shipment value, significantly less than the 1-2% that new importers often pay.

Conclusion

The true costs of customs bonds for US fabric mask imports extend far beyond the base premium to include government fees, compliance risks, and operational considerations that collectively impact total import expenses. For most importers, total bond-related costs range from 0.5% to 1.5% of shipment value, with continuous bonds becoming economically advantageous around 6-8 shipments annually.

Understanding these true costs enables accurate landed cost calculations, prevents unexpected expenses, and supports strategic decisions about import volume and frequency. The most cost-effective approach involves maintaining impeccable compliance records, selecting the appropriate bond type for your volume, and building strong relationships with customs brokers and surety providers.

Ready to optimize your customs bond strategy for fabric mask imports? Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss our import compliance expertise and how we can help you minimize bond costs while maintaining full regulatory compliance. We'll provide a detailed analysis of the most cost-effective bond approach for your specific import volume and product mix.