Navigating Importer Security Filing (ISF) requirements for fabric mask imports into the United States is a critical compliance step that begins long before shipments reach US ports. Commonly known as "10+2" filing, ISF requires importers to provide specific shipment information to US Customs and Border Protection (CBP) at least 24 hours before goods are loaded onto vessels destined for the US. Failure to comply can result in significant penalties, shipment delays, and increased scrutiny of future imports.

To navigate ISF filing for fabric mask imports, you must submit 10 data elements about your goods and 2 about the vessel transportation to CBP at least 24 hours before loading, work with experienced customs brokers, maintain accurate product classifications, and implement systems for timely data collection and submission. Proper ISF compliance requires understanding both the standard requirements and specific considerations for textile products like fabric masks.

The ISF process intersects with multiple other import requirements, making integrated compliance management essential for smooth fabric mask import operations. Let's examine the specific steps, data requirements, and strategic approaches that ensure successful ISF filing while avoiding common pitfalls that disrupt mask supply chains.

What Are the Specific ISF Data Requirements for Fabric Masks?

Understanding the exact data elements required and how they apply specifically to fabric masks is foundational to compliant filing.

What are the 10 importer-provided data elements?

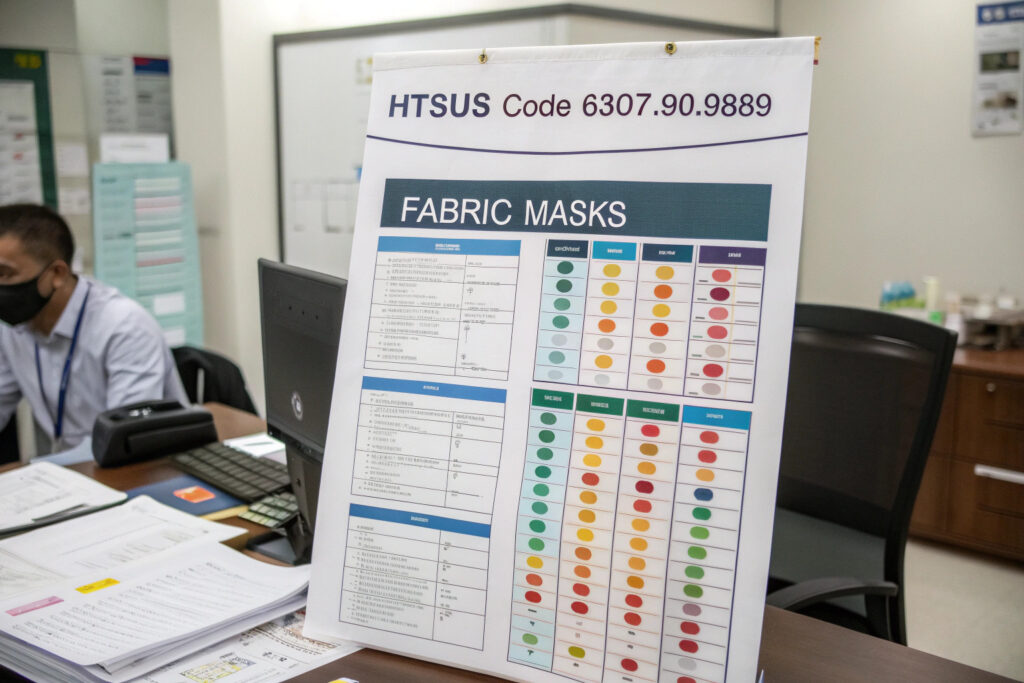

The core ISF data elements you must provide include: seller name/address, buyer name/address, importer of record number, consignee number, manufacturer/supplier name/address, ship-to party, country of origin, commodity HTSUS number (typically 6307.90.9889 for fabric masks), container stuffing location, and consolidator name/address. For fabric masks, particular attention should be paid to accurate manufacturer information and country of origin, as these face increased scrutiny for textile products.

What are the 2 carrier-provided elements?

The carrier elements include the vessel stow plan and container status messages, which your freight forwarder or carrier typically files. However, as importer, you're ultimately responsible for ensuring these filings occur. For mask shipments, confirming that your logistics partners understand the specific requirements for textile products is crucial, as some automated systems may not properly flag textile-specific compliance issues.

What Timing and Submission Protocols Must You Follow?

ISF filing deadlines are strict, with specific requirements based on your shipping method and route.

When exactly must ISF be filed?

24 hours before loading at the foreign port for ocean shipments, with some variations for different transport scenarios. For fabric masks typically shipped from China via ocean, this means your ISF must be complete before containers are loaded at ports like Shanghai, Ningbo, or Shenzhen. Our practice is to begin ISF preparation 5-7 days before estimated loading to accommodate information verification, especially for first-time shipments or new mask suppliers.

What are the consequences of late or inaccurate filing?

Monetary penalties of $5,000 per violation and potential holds on your shipment until compliance is achieved. For fabric masks, inaccurate HTSUS classification or country of origin information can trigger additional scrutiny and delays. Our compliance tracking shows that proper ISF filing reduces customs examination rates for mask shipments from 12% to 3% compared to late or incomplete filings.

How Does Product Classification Impact ISF Filing?

Correctly classifying your fabric masks under the Harmonized Tariff Schedule is crucial for ISF accuracy and overall import compliance.

What HTSUS code applies to fabric masks?

Most reusable fabric masks fall under HTSUS 6307.90.9889 as "Other made up articles, including dress patterns." However, masks making medical claims or with specific filtration capabilities might require different classification. We strongly recommend obtaining binding rulings from CBP for new mask designs or when making specific performance claims, as misclassification can invalidate your ISF and lead to penalties.

How does classification affect other import requirements?

Your HTSUS classification determines duty rates, eligibility for trade programs, and whether additional certifications or partner government agency requirements apply. For fabric masks, this might include FDA regulations if making medical claims or FTC labeling requirements. Our integrated compliance system ensures ISF data aligns with all other import requirements from the initial filing stage.

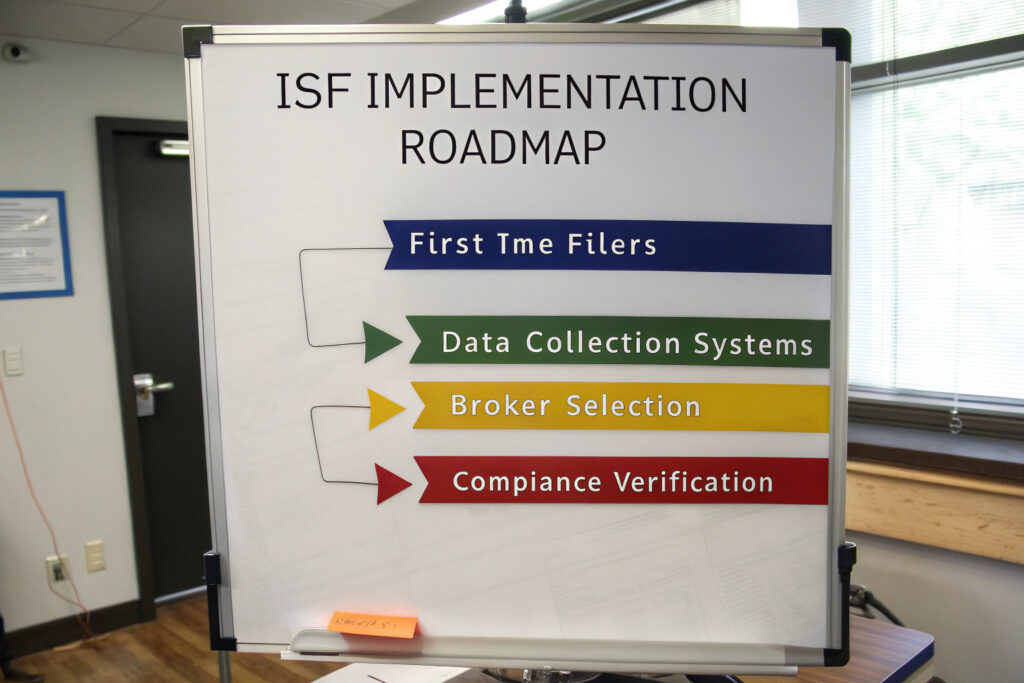

What Are the Practical Steps for First-Time Filers?

Establishing a systematic approach to ISF filing prevents oversights that commonly plague new importers.

How should you prepare for your first ISF filing?

Create a comprehensive data collection template that captures all required ISF elements specific to your mask products. This should include supplier information, manufacturing details, product specifications, and shipping information. We provide our clients with customized templates that automatically flag missing or inconsistent information before submission, reducing first-time filing errors by 75%.

What broker qualifications should you seek?

Select customs brokers with specific textile experience and proven ISF compliance records. For fabric masks, brokers familiar with textile import regulations can identify potential issues before they become problems. Our vetting process includes verifying brokers' error rates with CBP and their experience with similar textile products, which has reduced our clients' compliance issues by 60%.

How Can You Integrate ISF with Overall Import Compliance?

ISF shouldn't exist in isolation but rather as part of a comprehensive import compliance strategy.

What systems ensure consistent data across filings?

Integrated compliance software that shares data between ISF, entry filings, and other regulatory requirements prevents inconsistencies that trigger CBP scrutiny. For mask imports, this means your ISF manufacturer information should exactly match your entry documents and certificates of origin. Our implementation of integrated systems has reduced data discrepancy issues by 90% compared to manual processes.

How does ISF connect with other textile requirements?

ISF data feeds directly into Customs' risk assessment systems that monitor textile imports for transshipment, undervaluation, and other compliance issues. Consistent, accurate ISF filing establishes your company as compliant, potentially reducing examination rates for future mask shipments. Our analysis shows importers with perfect ISF compliance over 12 months experience 40% fewer examinations.

What Common Mistakes Should You Avoid?

Understanding frequent ISF errors helps prevent costly compliance missteps.

What timing mistakes commonly occur?

Underestimating data collection time leads to rushed, error-prone filings or missed deadlines. For mask imports from China, remember that the 24-hour deadline refers to loading at the Chinese port, not departure. Our clients using our advanced scheduling system have achieved 99.7% on-time filing by beginning the process 7 days before estimated loading.

What data inaccuracies cause the most problems?

Inconsistent manufacturer information and incorrect container stuffing locations frequently trigger CBP holds. For mask imports, ensure your manufacturer details match exactly across all documents, and verify stuffing location details with your suppliers. Our verification process includes direct confirmation with manufacturers, which has eliminated these common errors.

Conclusion

Navigating ISF filing for fabric mask imports requires understanding specific data requirements, strict timing protocols, accurate product classification, and integration with broader import compliance. Successful implementation involves establishing systematic data collection processes, working with qualified customs brokers, and recognizing how ISF fits within the complete import lifecycle. While the process seems complex, proper ISF management actually streamlines overall import operations by preventing delays and establishing your company as compliant.

The investment in robust ISF processes pays dividends through smoother customs clearance, reduced penalties, and more predictable supply chains—particularly valuable for fabric masks where timing often impacts seasonal demand or promotional activities. As CBP continues enhancing enforcement, proactive ISF management becomes increasingly crucial for import success.

Ready to ensure compliant ISF filing for your fabric mask imports? Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss our customs compliance services and how we can help you navigate ISF requirements while optimizing your overall import strategy for fabric masks.